United Overseas Bank Limited Co. (UOB) became the first foreign financial institution to invest mortgage-backed securities worth 300 billion won issued in Korea.

UOB, Singapore’s second largest investment bank, invested in won-based mortgage-back securities twice so far this year, HF said. It was the first time that a foreign financial institution invested won-based mortgage-back securities since 2004 when HF was established.

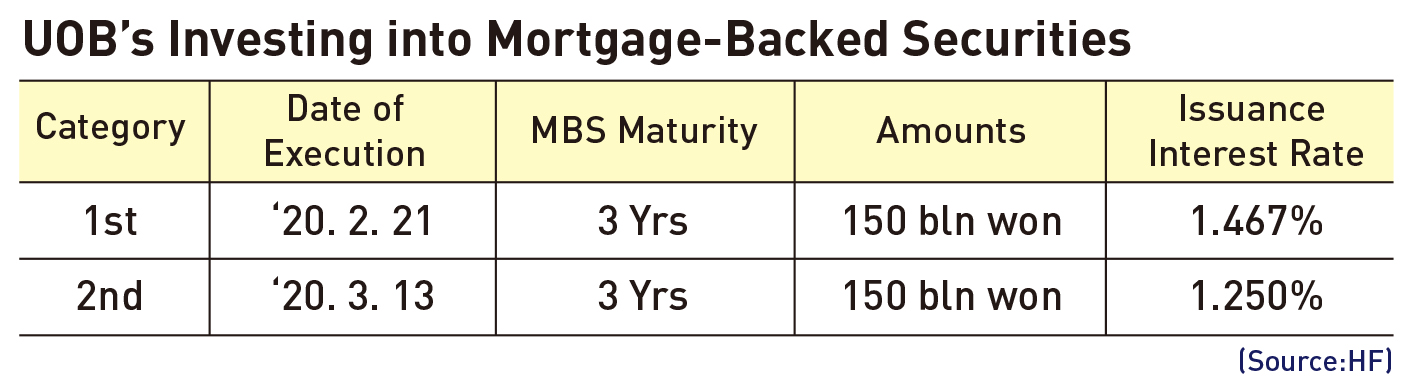

UOB invested mortgage-back securities worth 150 billion won, with a three-year maturity at an interest rate of 1.467 percent on Feb. 21 and MBSs worth 150 billion won, with a three-year maturity at an interest rate of 1.25 percent.

HF proactively responded to UOB’s requests on papers and site inspection to pass through its stern guidelines on investments.

“With the attracting investments from UOB, mortgage-backed securities, issued by HF, have proved to be a competitive product with creditworthiness corresponding to state bonds and monetary stabilization bonds in the international financial market,” a HF official said.

HF will continue to expand its investment base by issuing covered bonds in foreign countries and attracting investments from foreigners in Korea down the road, he added.

Meanwhile, HF plans to issue fluidization bonds worth 45 trillion this year to cope with a rise in policy mortgage supply such as loan conversions for low-income households and “Bogeumjari Loan,” a loan with an easy interest rate for newlywed couples.

In a related development, HF froze the interest rate of Bogeumjari Loan, a house-collateral loan with a long-term fixed interest rate and installment repayment. “u-Bogeumjari Loan” whose application is accepted through the website of HF and “T-Bogeumjari Loan are made available at annual interest rates ranging from 2.3 percent for a 10-year maturity to 2.55 percent for a 10-year maturity.

_주택금융공사 복지 사업에 트위지 공급.jpg)

President Lee Jeong-hwan of Korea Housing Finance Corp. (HF) and Managing Director Hwang Eun-young of Renault Samsung after they attend a ceremony to deliver 17 electric vehicle Twizy units to welfare facilities in the Busasn area in cooperation with the Busan Metropolitan Municipal Government and Community Chest of Korea. (Photo: HF)

HF Provides Support to the Underprivileged, Boosting Regional Economy

Korea Housing Finance Corp. (HF) has delivered 17 eco-friendly electric cars to social welfare facilities accommodating the underprivileged to alleviate difficulties they experience in the wake of the spread of COVID-19.

As the closing of social welfare facilities has been protracted, HF delivered 17 electric vehicle Twizy units worth 224.4 million won for the purpose of the welfare of the elderly with disabilities with welfare facilities in the Busan area in cooperation with the Busan Metropolitan Municipal Government and Community Chest of Korea, it said on April 9.

The Twizy units, delivered by HF, have a greater access to hillside roads in the Busan area, and they are expected to deliver lunch boxes to welfare facilities and offer services like visiting care to the underprivileged.

HF’s purchasing of the electric vehicles is expected to boost the sagging business of a local automaker, buffeted by the global spread of COVID-19 and to contribute to raising social awareness toward the purchase of eco-friendly cars to mitigate find dust emissions.

HF President Lee Jeong-hwan said, “This support is hoped to contribute to the regional community, grappling with the overcoming of hardships, caused by COVID-19.”

HF is committed to fulfilling its social responsibilities by carrying out diverse social contribution activities designed to promote shared growth with the local community like ones designed to boost the local economy and solve social problems, he added.