Chmn. Shin comes up with 3 proposals, including sale of their 4.9 mln shares, issue of ABS and IPO of Kyobo Life to settle FIs demand for put option

Chairman Shin Chang-jae of Kyobo Life Insurance Co. (Photo: Kyobo life)

Chairman Shin Chang-jae of Kyobo Life Insurance Co. has made a new proposal on the disposal of the shares held by the SE Private Equity and IMM PE totaling 4.92 million shares, or a 29.34-percent stake.

According to IB sources on Feb. 12, Chairman Shin made three proposals to divest their shares, including the issuance of ABS, the sale of their shares to a third party and the guarantee of the value of their shares after the life insurance firm’s initial public offering (IPO).

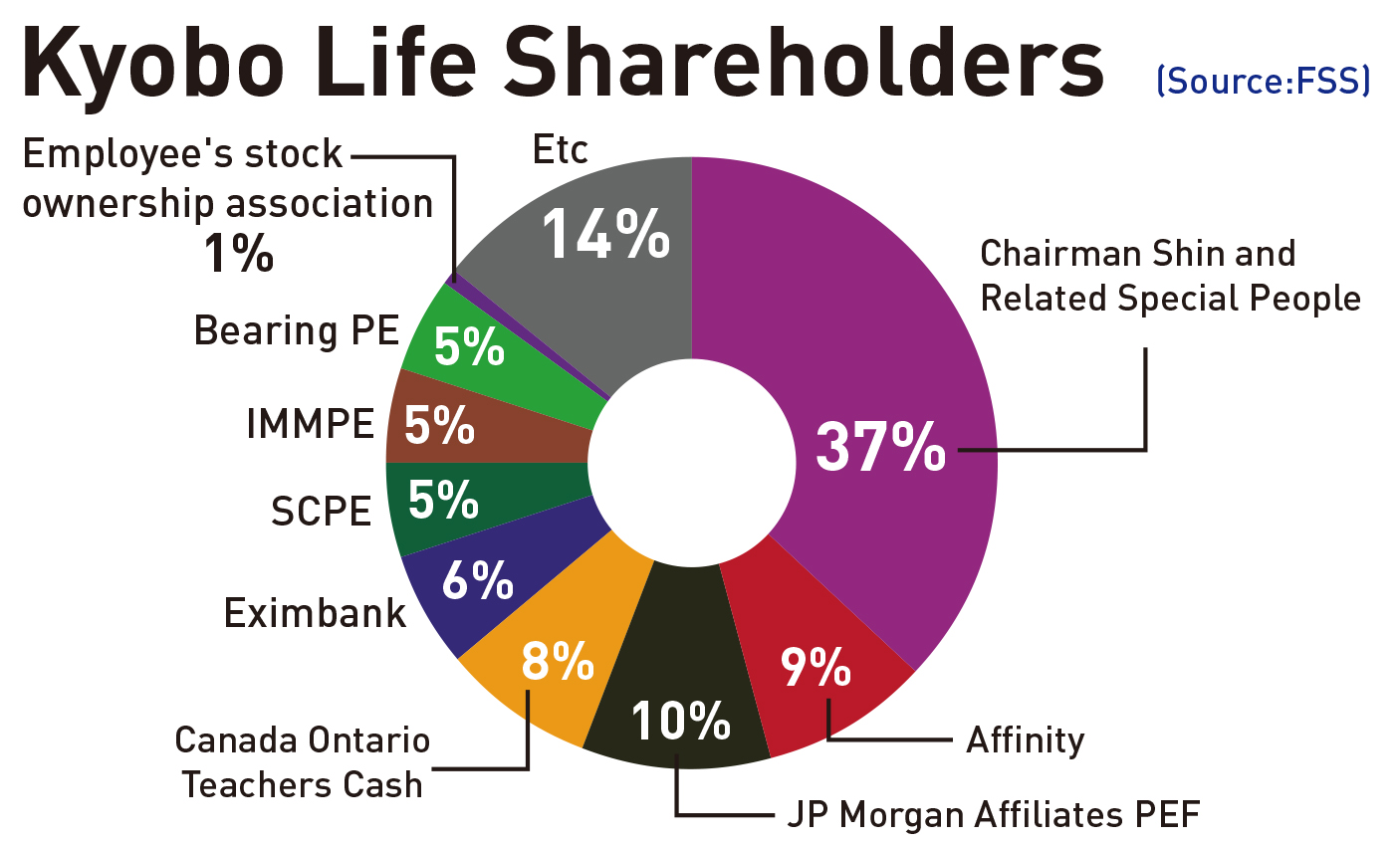

The bad blood between the FIs and Kyobo Life is likely to simmer down if any one of the chairman’s proposals is accepted by the FIs. Chairman Shin’s stake in the life insurance firm comes to 36.91 percent.

The chairman said the door is open to take care of issues raised by the FIs when the IPO is conducted successfully with the all the factors in the way are removed. He told a board meeting that he is ready to go all the way to settle all the issues concerning the company’s operation lest the company rattled by the FIs threat to exercise a put option for their shares and the related rumors.

He said the late founder of the life insurer ran the company under a founding spirit, calling for boosts in national education and the formation of the national assets for 60 decades. He said he not only inherited the ideal from his late father, but also has been trying his best for a joint development of the company for all the interested parties to create a social value.

Kyobo's FIs said in November 2018, that they wanted to exercise a put option since the insurer has not gone public for years. The FIs have also decided recently to submit an application for arbitration against Shin with the Korean Commercial Arbitration Board, demanding to recover damages from the insurer not going public for years.

A put option is a stock market device which gives the owner the right to sell an asset, at a specified price, by a predetermined date to a given party.

The bad blood between the two sides has deepened since the insurer decided not to submit its application for initial public offering (IPO) last year because of the nation's sluggish stock market, but a Kyobo Life Insurance official said the tension has yet to cross the red line.

"Local media reported the FIs have decided to file the arbitration against Shin, but we have not heard anything about the issue from them," the official said.

"They also said Shin will file a lawsuit against the accounting firm, but it's still in review. We don't think the tension between the two sides will escalate into a legal battle."

In 2012, the Kyobo Life FI consortium, including SC Private Equity and IMM PE, acquired a 24 percent stake in the insurer from the then Daewoo International for 1.2 trillion won ($1.06 billion). They also included a put option to resell the 24 percent stake to Shin if Kyobo Life did not go public before 2015.

Since the insurer had not submitted an application for IPO by 2015, the FIs informed Kyobo they would want to exercise the put option selling their stake to Shin.

The FIs also requested Deloitte Korea to calculate the total value of their 4.92 million shares. The accounting firm set 409,000 won per share upon their request, meaning Shin needs to pay 2.12 trillion won if they exercise the put option.

Market observers said the recent development between the two sides is a tug-of-war to gain the upper hand before the insure goes public.

"The FI also do not want the firm to nullify its IPO plan," said an analyst who is familiar with the issue. "Things will eventually ease out through talks."