Financial group to invest $100 mln in Texas Pacific Group’s Asia No. 7 Fund and $50 mln in MBK Partners SS Fund, with its affiliates chipping in the funds

_김광수.jpg)

Chairman Kim Kwang-soo of NH Financial Group.(Photo: NH Financial)

NH Financial Group is on its way to becoming a private equity fund (PEF) that is strong enough to rival such giants as Texas Pacific Group (TPG) and MBK Partners.

According to IB sources, the financial group’s financial affiliates will soon invest $100 million in the TPG’s Asia No. 7 Fund, which would be as large as $4.5 billion and $50 million in MBK Partners $1 billion Special Situation Fund.

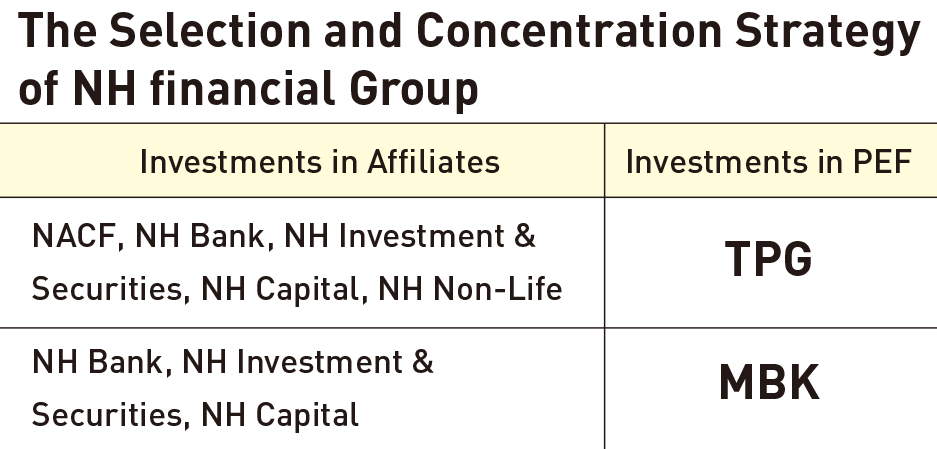

The financial group can now invest huge amounts because its affiliates can share the investment. For the funds invested in TPG, such NH Financial affiliates as NH Bank, NH Investment and Securities, NH Capital and NH Non-Life Insurance and NACF contributed. In MBK Partners SSF, NH Bank, NH Investment and Securities, and NH Capital are also expected to chip in.

NH Financial will determine the exact amount of funds to be invested in the PEFs, and each affiliate will chip in to form the funds, officials of NH Financial said. They want to make investments in those funds because they like the PEF tradition to treat the investors of large funds the “VIP Investors.”

Global retirement fund operators are ready to plunk down huge investments in new PEF funds being promoted by large PEF managers such as TPG and MBK Partners. On occasion, famous PEF fund operators opt to make choices on which funds to accept when they launch new PEF funds.

With so many investors preferring to make investment in new PEF funds, they should make more than $100 million to be treated as the VIP Investors, an official of a large PEF fund said.

The Texas Pacific Group, as it was originally known, was founded in 1992 by David Bonderman, James Coulter and William S. Price III. Prior to founding TPG, Bonderman and Coulter had worked for Robert M. Bass making leveraged buyout investments during the 1980s. In 1993, Coulter and Bonderman partnered with William S. Price III, who was Vice President of Strategic Planning and Business Development for GE Capital, to complete the buyout of Continental Airlines. At the time, TPG was virtually alone in its conviction that there was an investment opportunity with the airline. The plan included bringing in a new management team, improving aircraft utilization and focusing on lucrative routes. By 1998, TPG had generated an annual internal rate of return of 55% on its investment.

TPG, together with Warburg Pincus acquired Neiman Marcus Group, the owner of luxury retailers Neiman Marcus and Bergdorf Goodman, in a $5.1 billion buyout in May 2005. On December 19, 2006, TPG and Apollo Management announced an agreement to acquire the gaming company for $27.4 billion, including the assumption of existing debts.

MBK Partners is a private equity firm specializing in management buyouts, taking public companies private, buying subsidiary businesses through corporate divestitures, and industry roll-ups.

The firm primarily invests in companies in the telecommunications, media, banking, financial services, heavy industrials, pharmaceuticals, consumer, healthcare, logistics, retail, technology, and business services sectors. It invests in companies based in Asia with a focus on North Asia where the firm focuses on Korea, Japan, Greater China, Taiwan, and Hong Kong.

The firm may also consider investments outside of North Asia with preference on telecommunications, media, transport, manufacturing and financial services sectors. It seeks a controlling stake in its portfolio companies but may also consider significant minority investments in certain cases.

The firm seeks board representation in its portfolio companies. MBK Partners was founded in March 2005 and is based in Seoul, Korea with additional offices in Tokyo, Japan; Hong Kong, Hong Kong; and Shanghai, China.