OCI President Lee Woo-hyun revealed his determination to focus his company’s capabilities on reducing unit price costs in areas such as debottlenecking to ramp up the competitiveness of high pure polysilicon.

While delivering a speech at a session on the company’s business performance for the 4th quarter of 2017 at the Shinhan Investment Corp. building in Yeouido, Seoul, on Feb. 6, President Lee said, “Investments will focus on the Malaysian plant down the road, and I preferentially favor reducing unit price costs and expanding production through debottlenecking rather than large-scale facility expansion.”

Debottlenecking?is a process of getting more production out of existing plants and equipment by improving processes or revamping equipment. OCI is ramping up polysilicon competitiveness of the Malaysian plant because the demand for high-pure polysilicon is on the rise.

“The global photovoltaic power market is forecast to grow more than 17 percent this year,” Lee said. “Diverse areas, including China, EU and India will likely continue high growth with an annual increase rate of more than 15 percent in the next three and four years.”

Currently, OCI has a 15 percent share in the global polysilcon market, and the company will raise the share to up to 20 percent by 2020, he said.

NH Investment and Securities Revises OCI’s Price Outlook Upward

NH Investment and Securities Co. said on Feb. 7 that OCI achieved an earnings surprise for the 4th quarter of last year and revised upward its investment recommendations to “buy” while raising its target price from 130,000 won to 190,000 won.

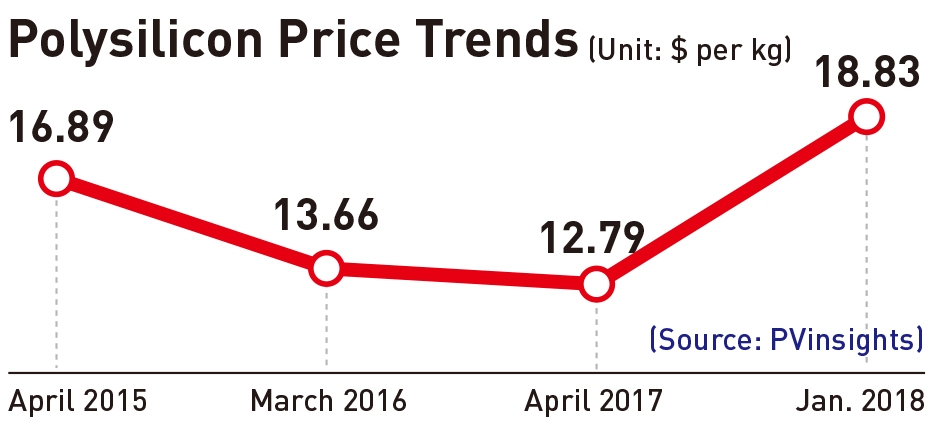

Researcher Chung Yeon-seung with NH Investment and Securities said OCI posted 852.5 billion won in the fourth quarter of 2017, a 21.2 percent surge over the same period of last year and 102.2 billion won in operating profit, a 3,664 percent jump during the same period. OCI achieved an earnings surprise due to rising prices of polysilicon, he said.

Chung analyzed that the growth of the divergent-type photovoltaic power market has shored up Chinese demand, and new solar power demand in EU and emerging countries has expanding, pushing up polisilicon prices.

Chinese companies’ polisilicon facility expansion and an off-season during the Chinese spring festival could undergo a correction, and technology development and dropping power generation unit prices are accelerating the spread of photovoltaic power, the researcher said.

As the spread of solar power generation is expected to get faster in a mid- and long-term perspective, polisilicon prices are predicted to be on the rise, and corporate values need to be considered depending on how to meet high-purity polisilicon demand, he said.