Samsung C&T Corp. is still considered undervalued relative to its peers, with its business showing huge improvement, from construction to trading.

Samsung C&T’s profit may exceed 1 trillion won next year if its overall operation turns out profits faster next year, with Samsung Biologics operation expected to vastly improve. The company holds a 43 percent stake in its affiliate.

But Samsung C&T’s share price rose only 5.2 percent as of the end of November, nowhere near the pace of the Kospi index, which rose 22.2 percent, according to the Korea Exchange on Nov. 3.

The weak value of Samsung C&T has been attributed to Samsung Group suspending its work on becoming a holding company, which did not bode well with Samsung C&T at the top of the group’s management system. Another factor has been a lawsuit brought against Cheiljedang in connection with its moves to turn itself into a holding company in 2015, threatening to nullify the holding company system, which did not go over well with investors for Samsung C&T.

The company booked 7.2 trillion won worth of new construction projects in the first three quarters this year, about 70 percent of the company’s 10.5 trillion won target. Samsung C&T most recently won a multi-level subway project in Singapore valued at 700 billion won, showing it is back on track by sweeping large building projects in S.E. Asia.

The company is on the verge of clinching a high-rise building construction project in Malaysia. An analyst with Kyobo Securities projected that Samsung C&T stands to improve its record for securing large overseas construction projects next year. Its strategy in securing foreign construction projects has been changed to be based more on the potential profitability of the projects.

Samsung C&T is to benefit from the Samsung Group’s increased facility investments next year, with inflows already exceeding 4 trillion won in the first three quarters of this year. 1 trillion won is expected to be invested in the last quarter of the year, far more than the 4.3 trillion won budgeted for the entire year.

Samsung Electronics is expanding its plants in Hwasung and Pyeongtaik this year, which will benefit other affiliates of the group Samsung C&T in particular.

A researcher with BNK said Samsung Electronics’ investments to expand its plants will be of great help to its affiliates in the construction area. A pickup in the fashion sector, due to the early arrival of the cold season, is also likely to help affiliates in the group boost their operational results for this year.

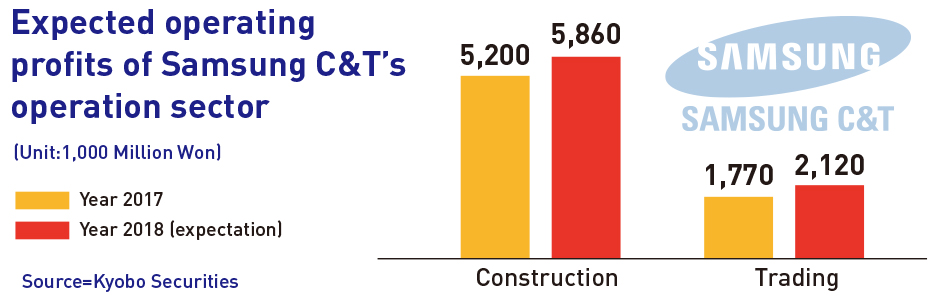

The trading sector of Samsung C&T, which makes up around 41 percent of the group’s revenue, appears to be providing a boost to the improved operation of the company, with the sector focusing on steel and chemical products after cleaning up its unprofitable overseas operations.

Samsung C&T Corporation, formerly Samsung Corporation, was founded in 1938 as a parent company of Samsung Group to engage in overseas sales operations. Since 1995, it has been largely focused on global engineering and construction projects, trade and investment, fashion and resorts.

The corporation is governed by an 11-member board of directors, made up of the president and CEOs of its four working groups ― Engineering & Construction; Trading & Investment; Fashion; and Resorts. Also in the mix are the corporation’s CFO and six independent members. Samsung C&T employs just under 13,000 people.