KB Financial Group continued to make a record profit joining rival financial groups to have the best first half in recent years thanks for boosts in interest income and non-banking earnings like the fees to make the first half earnings one of the best in recent years.

KB Financial in particular owes its outstanding record to the synergy from the take over of insurance and securities firms, which cemented its lead over rival financial groups.

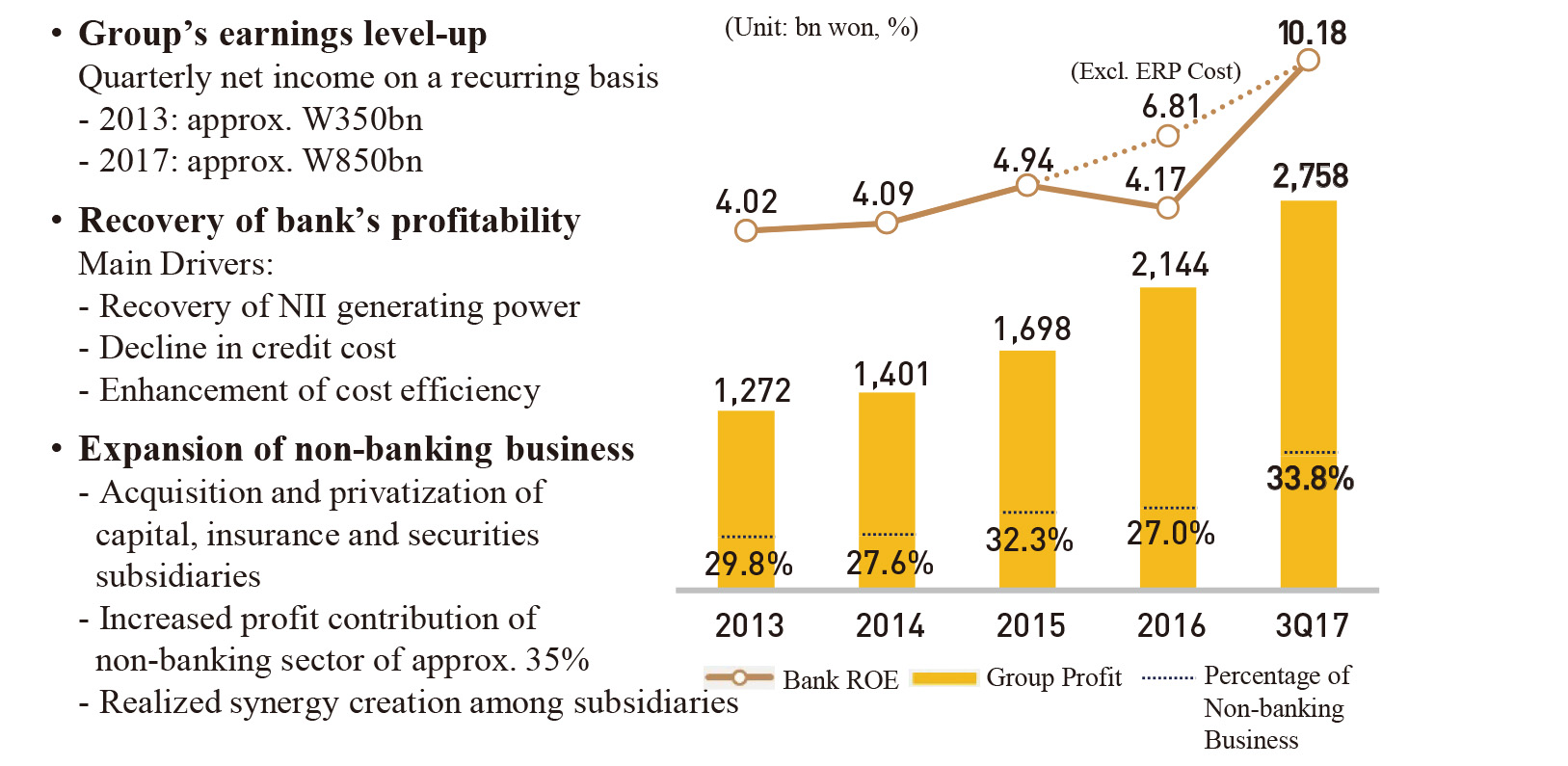

The group logged 897.5 billion won for net profit in the third quarter, which is far over the estimates 8780.3 billion won projected by the securities analysts as reported by Fn Guide, bringing the group’s profit in the first three quarters of the year to 2.757,7 trillion won, up 63 percent YoY.

The group posted the largest first half profit in its history and so was the profit for the first three quarters of the year KB Kookmin Bank played a major in boosting the group’s net profit with its profit in the third quarter to 6,321 billion won to bring total profit in the first half of the year to 1.841,3 trillion won, up 58.1 percent YoY with the increased interest margin due to the higher loan interest rates being the biggest factor in boosting its net profit. The interest earnings up to the three quarters of the year came to 5.687 trillion won, up 22.3 percent or 1.353 trillion won. The boosts in fee income for KB Securities also have been a big factor for the group’s huge profit increase so far this year with the fee income up to the third quarter this year coming to 1.522,2 trillion won with the rise in the fee income attributed to the securities firms merging with Hyundai Securities last year.

Officials of the group confirmed that the takeover of Hyundai Securities and KB Non-Life Insurance last year have been a big factor for the big boost in fee income for the group. They said the fee income accounted for 33.8 percent of the group’s income, rising from 27 percent last year due to takeover of both Hyundai Securities and KB Non-Life Insurance Co. Mirae Asset Dawoo Research staff Kim Hye-seung said with the retaining of Chairman Yoon Jong-kyu, the group has been able to stabilize its management structure and improve its operation with the management strategy sustained as before with not much changes. KB Financial Group, the second-largest banking group in net assets, posted 870.1 billion won ($763.7 million) of net profit in the first quarter, a 59.7 percent rise on-year, according to the group’s earnings report April 19.

The net profit of the holding company, which operates financial units including Kookmin Bank, the second-largest commercial lender in market cap, skyrocketed 91.7 percent compared to the previous quarter, the report indicated April 19.Kookmin Bank in the first quarter posted a net profit of 663.5 billion won, up 71.4 percent on-year.

The report also showed that the BIS ratio of both the group and its bank surpassed 15 percent, recording 15.75 percent and 16.71 percent, respectively. KB Financial Group eyes outsizing Shinhan Financial Group, the largest financial group in Korea, by bringing KB Insurance and KB Capital completely under it this year.

At KB Financial, our strength lies in simplifying the complex. We believe in the power of listening. We strive to become intimately familiar with your personal preferences and needs. Then we construct an integrated family office platform with our team of professionals- coordinating financial, tax and estate planning, insurance solutions, wealth management and merchant banking to help support your quest for financial success.

KB Financial coordinates essential wealth management activities through our captive entities. KB Financial Partners, LLC, a Registered Investment Advisor and Insurance Agency, provides investment advice, financial planning, insurance solutions, and corporate retirement plan consulting. Through KB Financial Advisory Partners, LLC, our team of professionals offer corporate and business advisory, structure and transaction consulting, tax and estate planning and compliance services.