Hyundai Robotics was inaugurated as the holding company of Hyundai Heavy Industries (HHI) Group on Aug. 31. Hyundai Robotics unveiled a vision to join the top five integrated robotics companies in the world by 2021.

HHI Vice Chairman Kwon Oh-kap, Hyundai Robotics President Yoon Jeung-keun and Daegu Mayor Kwon Young-jin participated in an inaugural ceremony.

In 1984, Hyundai Robotics started off as a robotics business of HHI. The company has grown into the No. 1 Korean robotics leader as it successfully developed a six-axis articulated robot in 1995 and a robot for LCDs in 2007. After being spin out from HHI Group in April, Hyundai Robotics set up a new “smart factory” in Daegu, utilizing ICT production technologies to be capable of gathering real-time data related to all systems in the plant.

The plant has seen its annual robot production nearly double from 4,800 units to about 8,000 units.

Hyundai Robotics has seen its business performance improve since being spun off. The company’s sales for the 2nd quarter of the year were up about 10 percent from the same period last year. Hyundai Robotics also chalked up operating profit growth of 10 percent.

Hyundai Robotics President Yoon said, “The industrial robot market is forecast to surge at annual average growth rate of a range of 10 percent.” The company plans to increase R&D investments to rise to an integrated robot company which is predicted to chalk up 500 billion won in sales by 2021, he added.

HHI saw its stock decline due to slumping shipbuilding orders, but Hyundai Robotics has had the opposite fortune. The reason is chances are high that Hyundai Robotics can buy stakes in HHI for less money. Stock markets showed that HHI shares were traded at 141,500 won per share, a 1.05 percent drop over the previous day, and a 24.1 percent nose-dive from June 14 when shares were traded at 186,500 won per share.

HHI shares showed signs of rising thanks to expectations over the resurgence of the Korean shipbuilding industry three months ago, but things have reversed the tide with “an order cliff” forecast in the second half. The company recently lost a competition to win large container ship orders to Chinese rivals.

Han Young-soo, an analyst with Samsung Securities, said, “HHI logged a combined 1.96 billion in cumulative shipbuilding and marine orders in July, representing a 16 percent surge over the same period of last year.” The figure, which accounted for about 33 percent of the annually 2017 goal, showed signs of slumping.

It is uncertain whether the company will achieve the 2017 goal even though there has been an improvement in winning orders for the second half of the year.

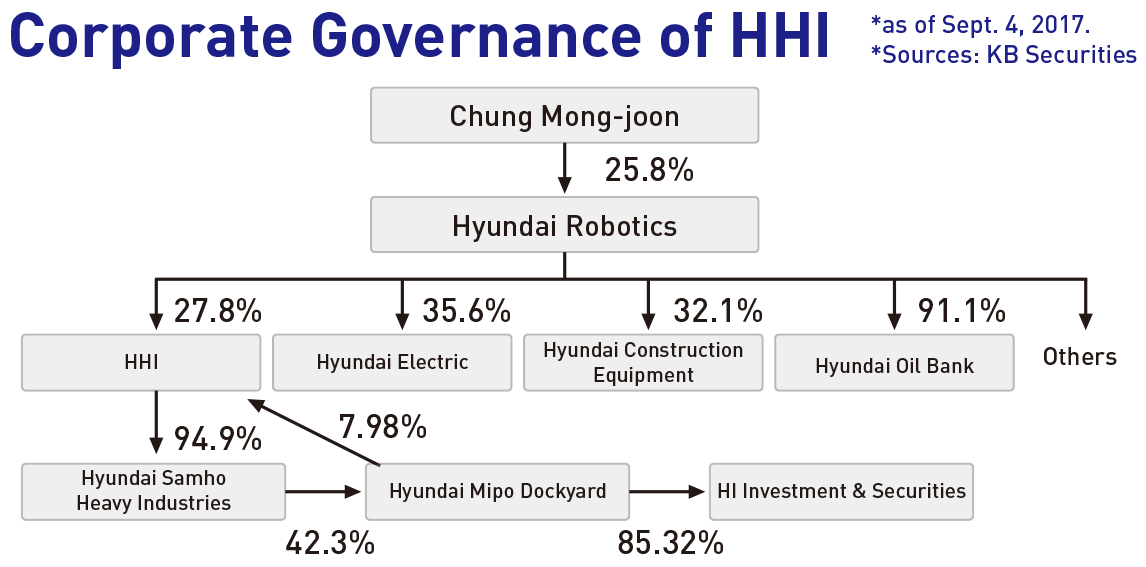

Despite the bleak situation, HHI Group’s overall prospects are not so bad. Since Hyundai Robotics shifting to a holding company, the company has more room to maneuver now than it did in the first half. The group has a cross-sharing structure for Hyundai Robotics, HHI, Hyundai Samho Heavy Industries (HSHI), Hyundai Mipo Dockyard (HMD), and HHI, respectively. The group is required to dispose of cross-sharing holdings by March 2019. Hyundai Robotics acquired HMD’s stakes in Hyundai Electric and Hyundai Construction Machinery for 193.1 billion won.

Chung Dong-ik, an analyst with KB Securities, said stakes in Hyundai Electric and Hyundai Construction Machinery were purchased in cash with a relatively small sum of money, but the acquisition of a stake in HHI is not easy due to the involvement of huge amounts of money. Hyundai Robotics is expected to take its time in acquiring HHI through dividends accruing from a 91.1 percent stake in Hyundai Oil Bank, or it could spin off the investment division of HMD and merge it, he said.

Choi Jin-myung, an analyst with Cape Investment and Securities Co., said Hyundai Robotics will be able to secure necessary money through the issuance of corporate bonds because of its financial soundness.