The Industrial Bank of Korea (IBK) may be about to declare the highest dividend in its history this year, attracting the attention of stock market investors at home and abroad.

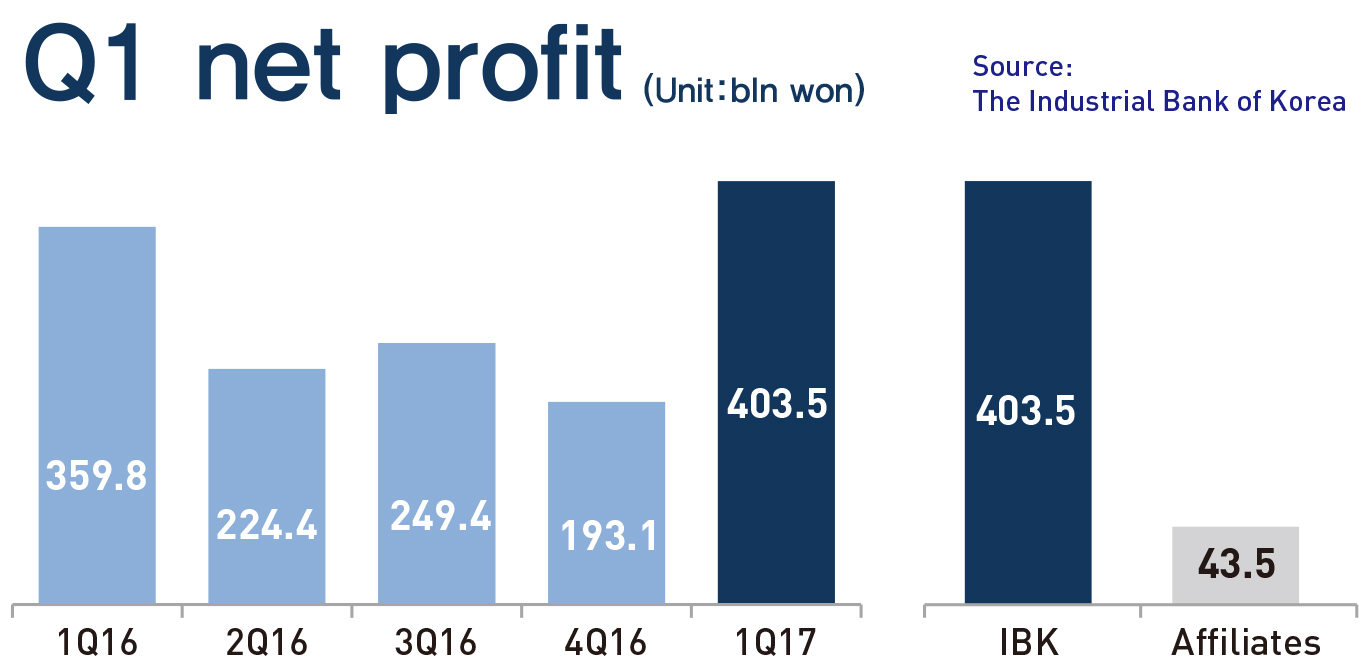

On a consolidated basis with affiliates including IBK Capital and IBK Investment and Securities, IBK recorded 437.7 billion won in net profit in the first quarter, up 15.9 percent year-on-year, the biggest jump since 2012. The figures include the sales proceeds (44.5 billion won) of its stake in E-Mart and the gains from the depreciation of the U.S. dollar (34.3 billion won), but interest earnings were strong.

The bank, the biggest profit earner in the group, taking up around 90 percent of its income, did its part this year, too, by logging 403.5 billion won in net profit. That’s a jump of 12.1 percent YoY in the first quarter out of total interest earnings of 1.153,8 trillion won, up 3.7 percent YoY. Its non-interest earnings including one-time earnings, came to 205.9 billion won, up 156.1 percent YoY.

The bank’s NIM stood at 1.92 percent in the first quarter, higher by 0.4 percentage points than those of Shinhan Bank’s 1.53 percent. Analysts said the bank’s high NIM was due to the inclusion of its card unit, but the NIM without the credit card unit came to 1.70 percent, which is still higher than most other commercial banks.

With the bank providing 80 percent of its loans to SMEs, IBK had a higher NPL ratio (1.48 percent) in the first quarter, compared to that in the same period last year (1.43 percent). Officials of the bank explained that the Q1 NPL included 72.5 billion won that the bank failed to collect form Monuel Co. and was charged to the NPL, raising the ratio by around 0.4 percentage points. The NPL without the defaulted loans to Monuel stand at 1.44 percent about the same as other commercial banks.

The bank plans to slow down its loan provision to SME borrowers to 4.8 percent this year compared to 6.6 percent last year as the bank prefers stability in its loans to growth, projecting its net profit for the year amounted to 1.314,6 trillion won, up 13.5 percent YoY. At the 12th annual FinTech Demo Day in Seoul, the chairman of South Korea’s Financial Services Commission, Yim Jong-yong, announced that his department will “Lay the systemic groundwork for the spread of digital currency.”

The FSC is the South Korean government office overseeing financial services. In 2008, the department assumed authority over all financial policies regarding the financial market from the Ministry of Finance, making it the government’s top financial regulator. While no details were given about the form or technology that the FSC’s digital currency will use, other than a suggestion that it would include a blockchain, a consortium on blockchain technology to jointly research and run pilot projects will be launched by the government and the local financial industry players this year.

According to Yonhap News, Yim announced that his department is offering three trillion won in funding over the next three years, worth about $2.65 billion, to financially support the development of the fintech sector.

Yim described the measures behind his department’s FinTech funding spree as the, "Basic direction" of their second-stage fintech development roadmap, which they plan to unveil in the first quarter of this year.

"In the second stage, the government will place a focus on re-designing the existing system to be suitable for the fintech environment," Yim said.

Although this is one of the first times that the government has mentioned blockchains, the country’s private sector has been in the news for bitcoin and blockchain technology adoption over the past few years.

In February, KB Kookmin, announced a partnership with Coinplug, the No. 2 bitcoin exchange by Korean won volume, to develop remittance and data storage services.

Coinplug has been building bitcoin financial service infrastructure in Korea since 2014, including over 7,000 bitcoin ATM machines across the country, as well as 24,000 convenience store locations that sell its okBitcard, an over-the-counter way to instantly buy bitcoins.