Mirae Asset Daewoo will introduce Vietnam CB Fund in Korea scaled at 67 billion won, which is projected to earn more than 30 percent in Vietnam.

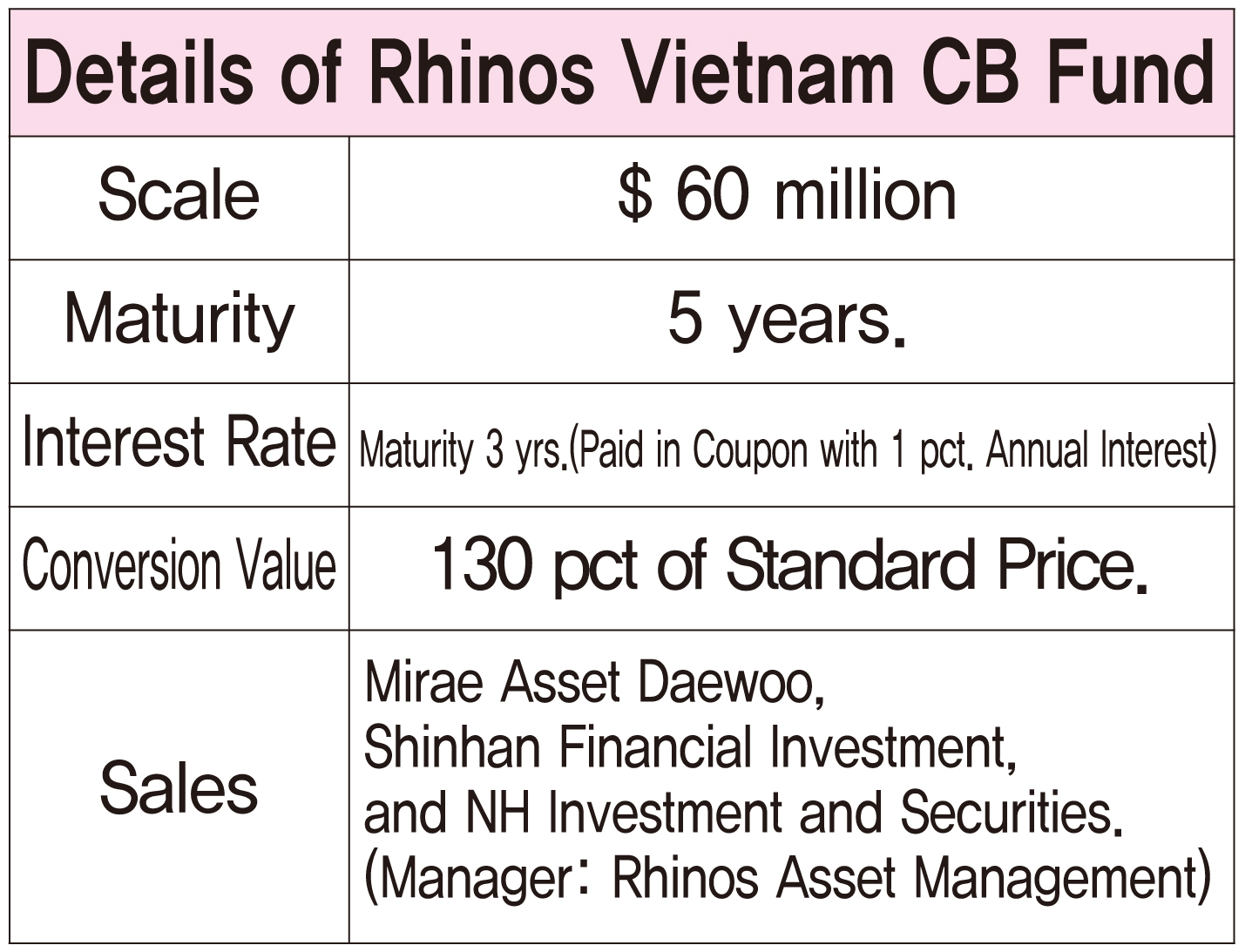

Mirae Asset Group said on Oct. 19 it is slated to introduce the No. 1 Linos Vietnam CB Professional Investment Type Private Equity Fund with an investment fund amounting to $60 million around Nov. 8. It will be made up of investments by Shinhan Financial Investment, NH Investment and Securities and Linos Asset Management.

The PEF will be invested in the CBs to be issued by the Ho Chi Minh City Infrastructure Investment (CII), which is listed on VN30, the representative stock index in the Southeast Asian country.

CII is engaged in the construction of infrastructure, including bridges, highways, and dams in Vietnam and management of those infrastructures as the largest private infrastructural builder in terms of total assets and market value in the Southeast Asian country. VOI, in which Vietnamese state wealth management firm holds a stake, is the largest stake holder in CII at 9.2 percent.

Mirae Asset Daewoo is counting on the potential of CII shares to make a rapid jump in price in the days ahead with five major projects being undertaken by CII, including highways around Hanoi, which are expected to be completed in succession from next year and through 2019. The company is projected to see its annual sales to jump by five times and operating profit by three times during the period. The CII CBs can be converted to shares after a year from the issuance at the price 130 percent higher than the share price at the time of conversion.

South Korea’s securities firm Mirae Asset Securities Co. will invest 400 billion won ($349.80 million) to acquire Keangnam Hanoi Landmark Tower in Vietnam, also known as Keangnam Landmark 72. It is the largest overseas alternative investment made by the company. The securities firm announced on Apr. 12 that it will join hands with global investment company AON BGN, a former AON Holdings, to take over the Landmark 72 in Hanoi.

The building was constructed by Korean construction company Keangnam Enterprises Co. in 2012, but with the company going into court receivership, the ownership of the building has been transferred to creditors. With two 50-floor residence buildings and a 72-floor tower building,

The Landmark 72 is the tallest skyscraper in Vietnam at a height of 350 meters. Currently, the world-famous Intercontinental Hotel, offices of Korea’s large companies, 922 apartments, serviced residence hotel and stores are located in the building. Mirae Asset Securities will invest 400 billion won ($349.80 million) in total including 300 billion won ($262.35 million) worth of senior loans and 100 billion won ($87.45 million) in convertible bonds in the takeover of the building, while AON will invest the remaining 100 billion won ($87.45 million).

The securities firm is also expected to commercialize some of the investment to provide them for Korean individual and institutional investors.

The investment in Landmark 72 is the largest global alternative investment ever made by Mirae Asset Securities. The securities firm announced its plan in Sept. last year to strengthen the overseas alternative investment and principal investment through a paid-in capital increase worth 1.2 trillion won ($1.05 billion).

Meanwhile, Chairman Park announced the plan to increase capital by 300 billion to 500 billion won ($264.32 to $440.53 million) to its affiliates in the U.S., Indonesia, Vietnam and London, in which Mirae Asset Daewoo has already local offices, earlier. Thus, additional paid-in capital increase will go on in the future.