Hana Financial Group posted its best third quarter since 2012 thanks to synergy from the merger with the Korea Exchange Bank and real estate investments, boosting this year’s profit over that of last year’s.

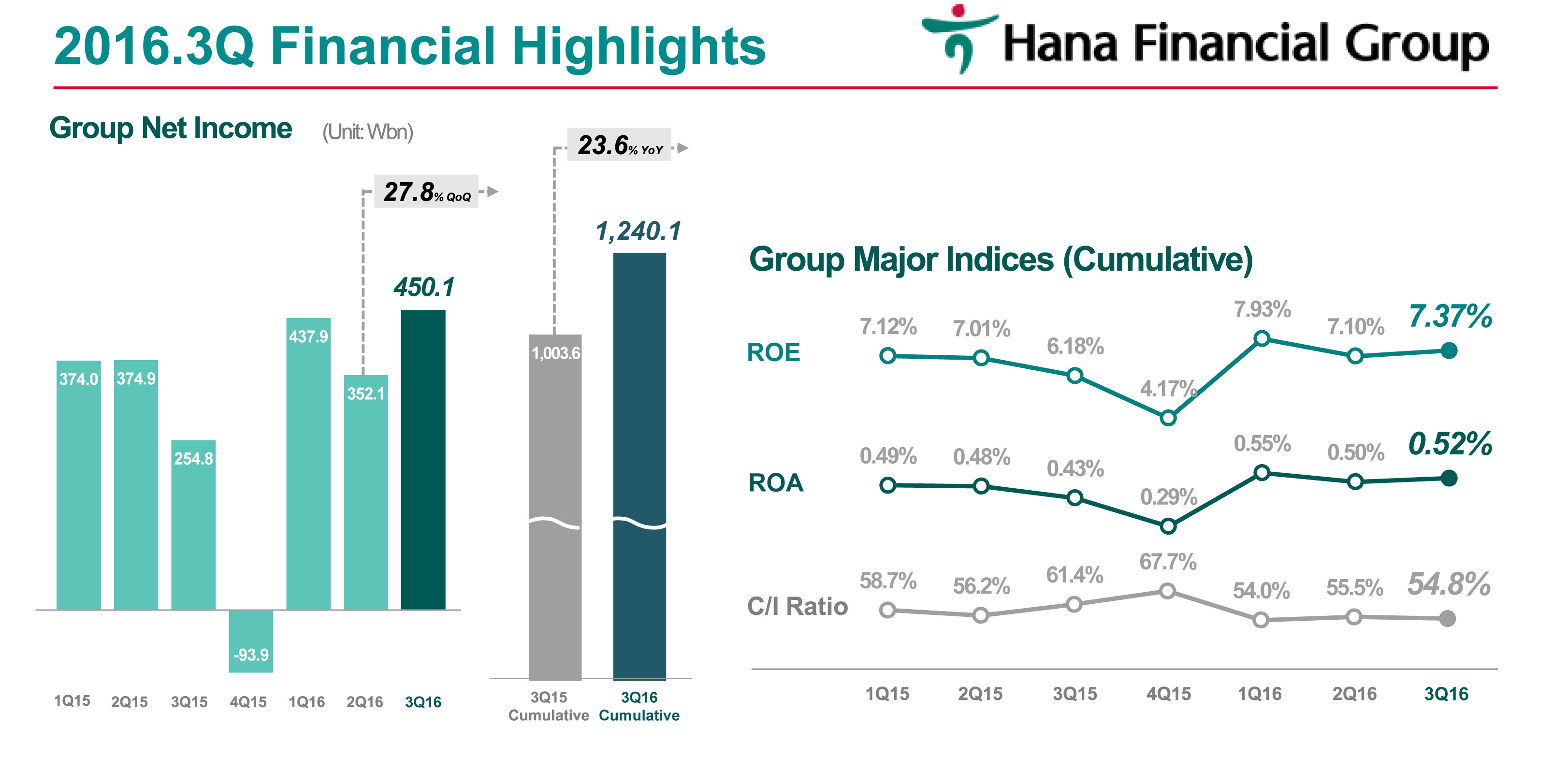

The financial group said on Oct. 23 that its Q3 profit amounted to 450.1 billion won on a consolidated basis, up 76.6 percent YoY, the best quarterly record since the Q1 in 2012, bringing profit in the first three quarters of the year to 1.240,1 trillion won, overtaking last year’s total profit of 909.7 billion won. Officials of the group attributed the improvement to synergy gained from the merger with KEB in September last year, explaining the surprise earnings in Q3.

One benefit from the merger has been cuts to the bank’s general expenses, including those related to the marketing, down 12.6 percent while the earnings in interest jumped 2 percent to 3.158,3 trillion won.

However, the group's net interest margin, a key barometer of profitability, slipped 0.01 percentage point to 1.8 percent in the third quarter from a quarter earlier.

Flagship KEB Hana Bank posted a net profit of 1.26 trillion won in the January-September period, marking a 180-percent spike from a year earlier. KEB Hana was launched Sept. 1, 2015, after Hana Financial Group acquired what was then Korea Exchange Bank (KEB).

Hana Financial Group said the increase in profit was largely attributed to synergy effects following the acquisition of the KEB.

Shares of Hana Financial Group closed at 32,000 won on the Seoul bourse, up 0.31 percent from the previous session's close, outperforming the broader KOSPI's 0.37 percent loss.

Hana Financial said in a press statement that it reduced its selling, general and administrative costs, which include employee wages, by 12.6 percent to 954.5 billion won in the third quarter.

"Beginning this year, the company's expenses have been stably managed at under 1 trillion won," the group said.

Despite the Bank of Korea's key interest rate being slashed to a record low of 1.25 percent last June, Hana Financial’s net interest margin stood relatively stable at 1.8 percent, the same as last year, but dropped 0.01 percentage point from the second quarter. It is showing improvement in its key indicators related to its asset soundness and capital adequacy as it de-leverages its position on conglomerate lending, analysts say.

After excluding its income from foreign exchange and subsidiaries, the group's net income stood at 380 billion won, which analysts say still surpassed the market consensus of 337.4 billion won.

"This is due to its cost-cutting efforts following the merger (between Hana Bank and Korea Exchange Bank)," said Kim Soo-hyun, analyst at Shinhan Investment.